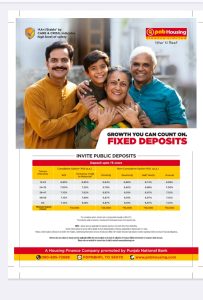

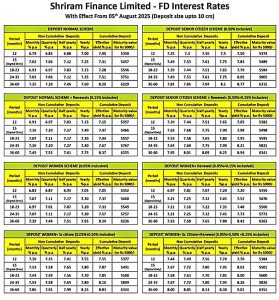

Fixed Deposit

A Fixed Deposit (FD) is one of the most reliable and great ways to increase your savings with guaranteed returns. Fixed deposits have a fixed amount of maturity time and you earn interest on the amount at a set rate, and ensure that your money grows, secure and guaranteed from market risks.

Fixed deposits will provide the desired amount of safety, stability and liquidity needed to achieve both short-term intent nlichkeiten in mind or long-term financial security. A great way to take advantage of FDs is that they have their own set of maturity time and vary in their own interest gained per time period and also require little to no risk to withdraw your deposit. Fixed Deposits are a great way to incorporate into your overall financial consideration.

Types of Fixed Deposits

Regular Fixed Deposit

- Deposit a lump sum for a fixed tenure and earn guaranteed interest.

- Safe and stable—ideal for risk-averse investors.

- Flexible tenures ranging from a few months to several years.

Tax-Saving Fixed Deposit

- Lock-in period of 5 years with assured returns.

- Eligible for tax deduction under Section 80C of the Income Tax Act.

- Ideal for individuals looking to save on taxes while growing wealth.

Cumulative Fixed Deposit

- Interest gets compounded and paid at maturity.

- Helps build a bigger corpus over time.

- Perfect for long-term investors who don’t need periodic payouts.

Non-Cumulative Fixed Deposit

- Earn interest payouts monthly, quarterly, half-yearly, or annually.

- Provides a regular income stream for daily expenses.

- Best suited for retirees or individuals seeking steady cash flow.

Senior Citizen Fixed Deposit

- Higher interest rates exclusively for senior citizens.

- Ensures better growth and financial independence in retirement.

- Reliable choice for safe and assured income post-retirement.