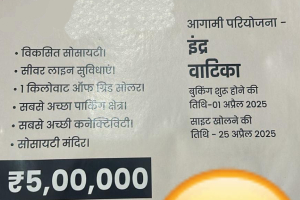

Real Estate

Based on experience, plots are better than flats for investment.

My own plot in Noida grew 2.5X in just 3 years, while flats in the same area did not give such appreciation.

With a plot, you have the flexibility to construct 1 floor in ₹10–15 lakh, but in the case of a flat, you can’t expand further.

That’s why, around the age of 40, one strong and safe investment should be in a plot. It gives both appreciation and future construction potential.

2 Things to Remember Before Buying a Plot

- Check Khasra Number – Don’t buy unauthorized land.

- Section 143 Approval – Ensure the land is converted to residential, so you can build your home legally.

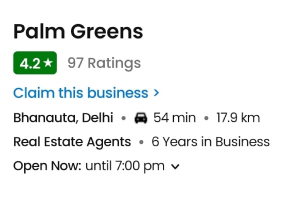

We always bring verified plots so your investment stays safe and profitable

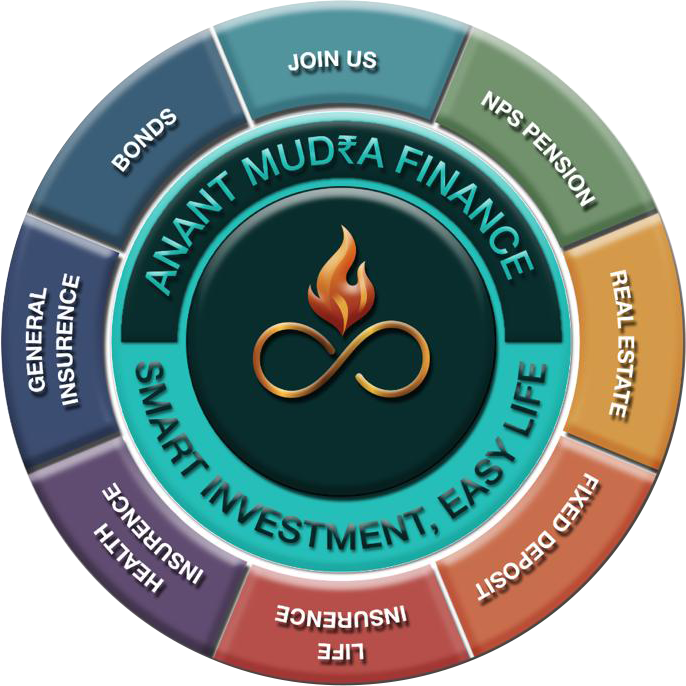

Types of Investment Options

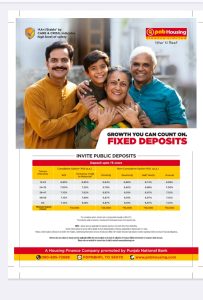

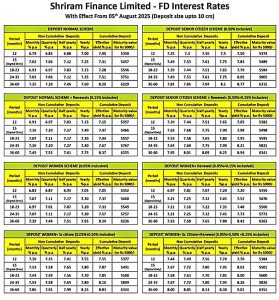

Fixed Income Investments

- Includes Fixed Deposits, Bonds, and Guaranteed Plans.

- Offers safety, stability, and predictable returns.

- Ideal for conservative investors and retirees.

Market-Linked Investments

- Includes Mutual Funds, SIPs, and Equity-linked products.

- Potential for higher returns with some market risk.

- Best for long-term wealth creation and inflation beating.

Retirement & Pension Investments

- Includes NPS (National Pension System) and retirement-focused plans.

- Helps you build a secure corpus for post-retirement years.

- Provides tax benefits along with financial independence in old age.

Tax-Saving Investments

- ELSS Funds, Tax-Saving FDs, and NPS contributions.

- Helps reduce taxable income while growing wealth.

- Ideal for salaried and self-employed individuals.

Custom Investment Solutions

- Mix of guaranteed and growth-oriented products.

- Tailored as per life stage (young professionals, families, or retirees).

- Designed to achieve both short-term and long-term goals.

International Investments

- Includes Global Mutual Funds, ETFs, and Foreign Stocks.

- Provides global diversification and access to international markets.

- Ideal for investors seeking growth beyond domestic opportunities.