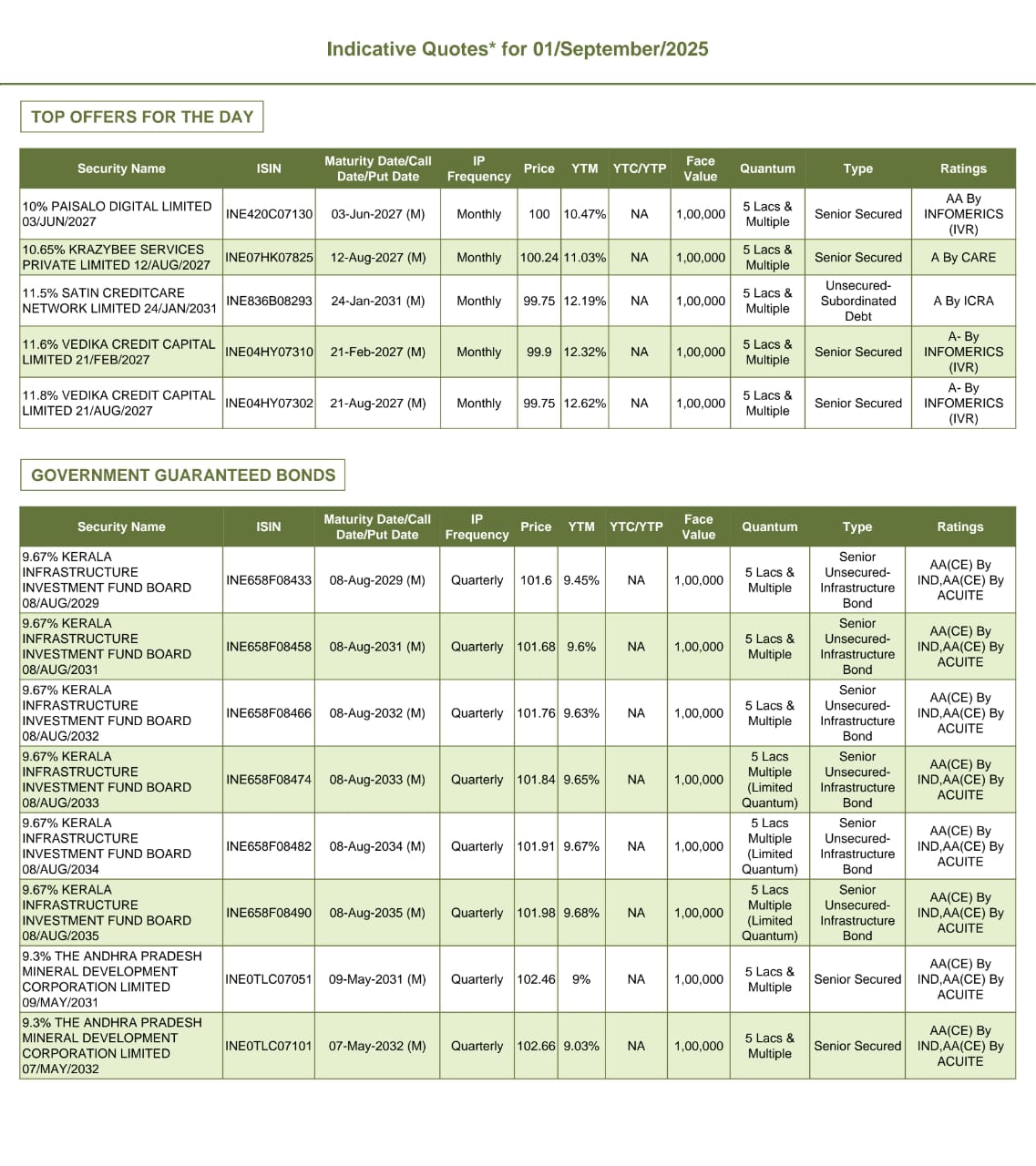

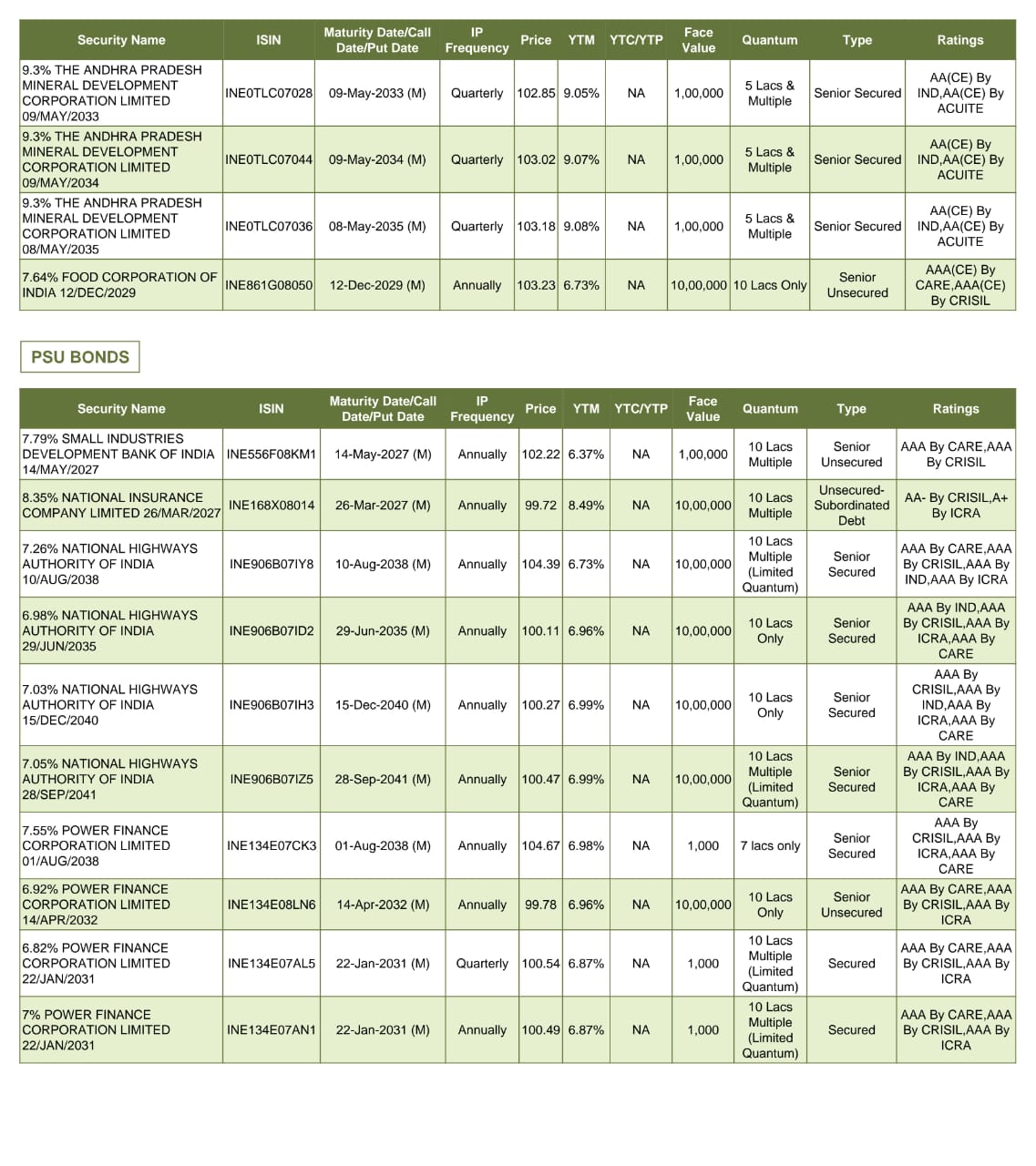

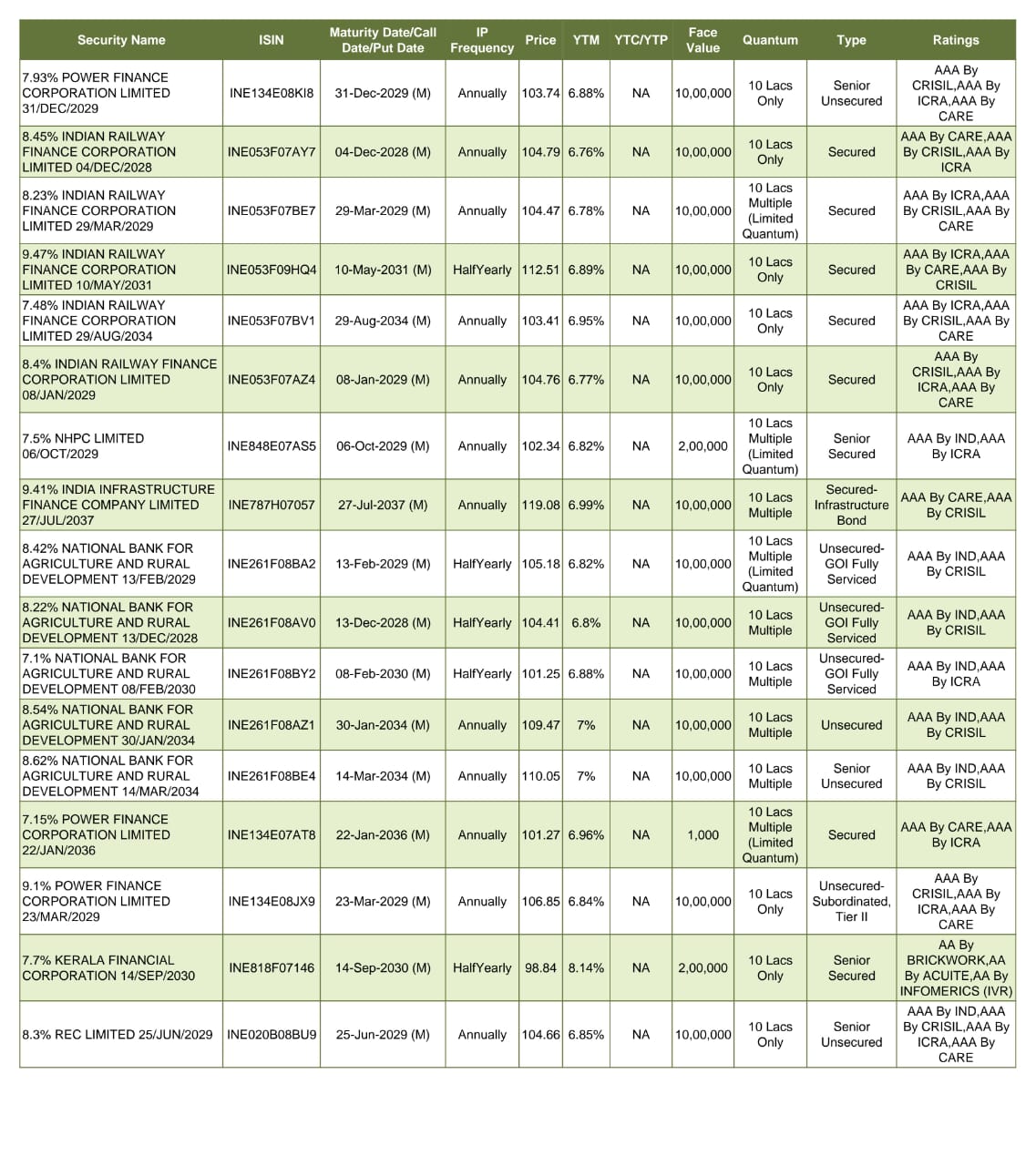

Bonds

For investors seeking lower risk and stability of income bonds are one of the best investment opportunities available. When you invest in bonds, you are lending money to governments, corporations, or financial institutions for a specific period in exchange for fixed interest (coupon payments). The principal is returned to you upon maturity, making bonds safer investments and a predictable way to grow wealth.

Bonds provide interest payments, flexible tenures, lower risk than equity markets, and provide investors with security as well as consistent income.

Types of Bonds

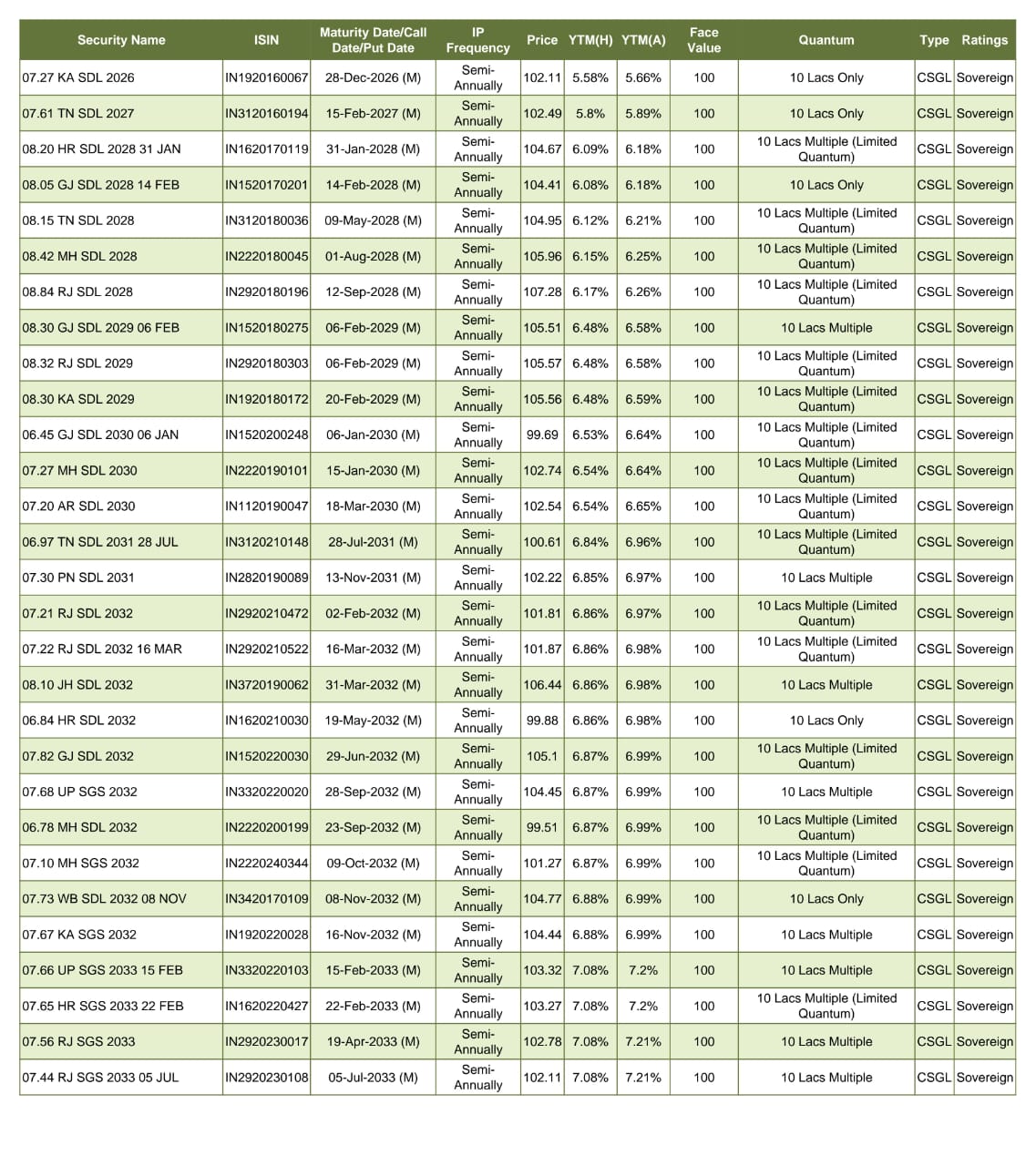

Government Bonds

- Issued by the central or state government.

- Backed by sovereign guarantee, offering maximum safety.

- Ideal for conservative investors seeking risk-free returns.

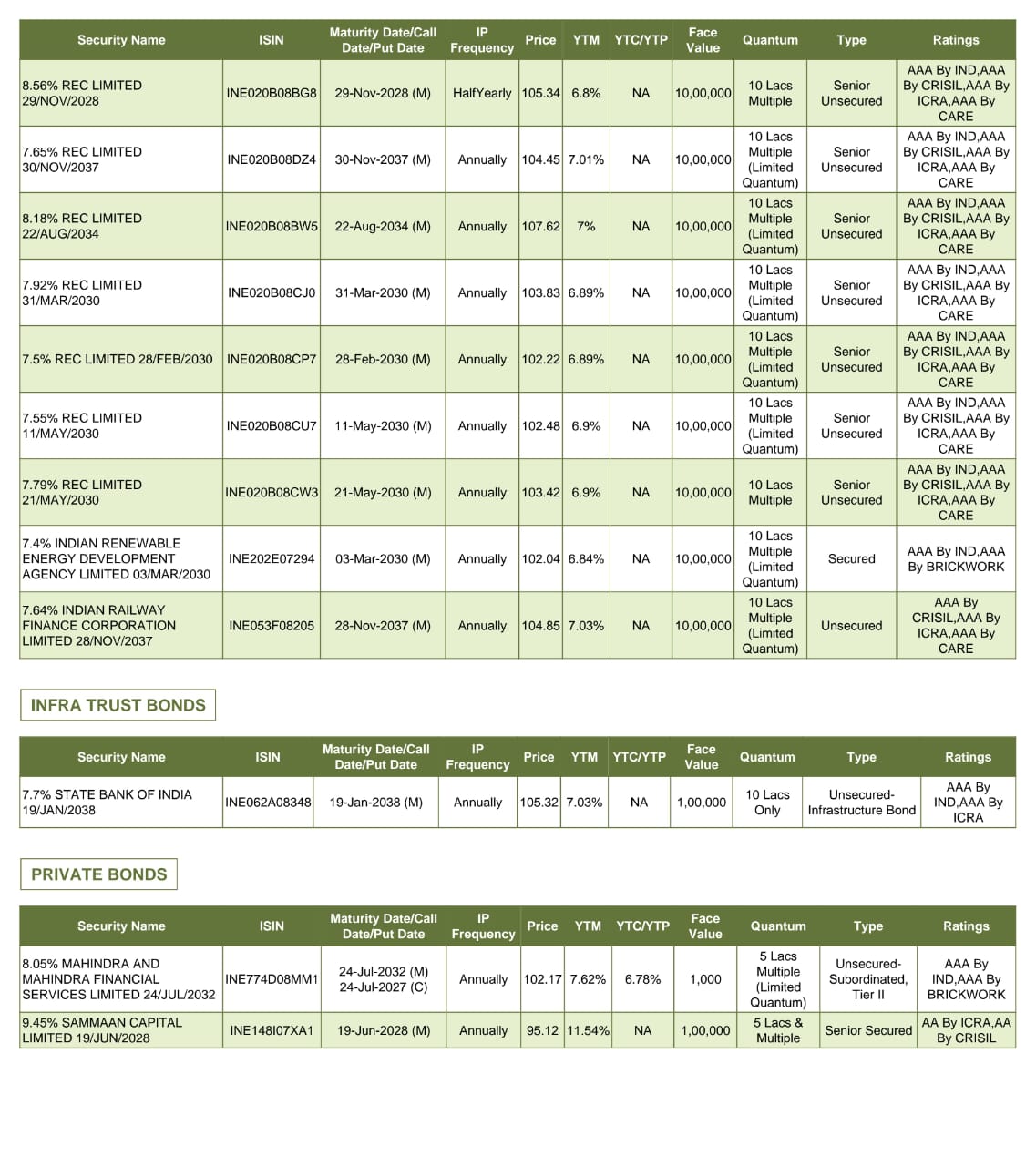

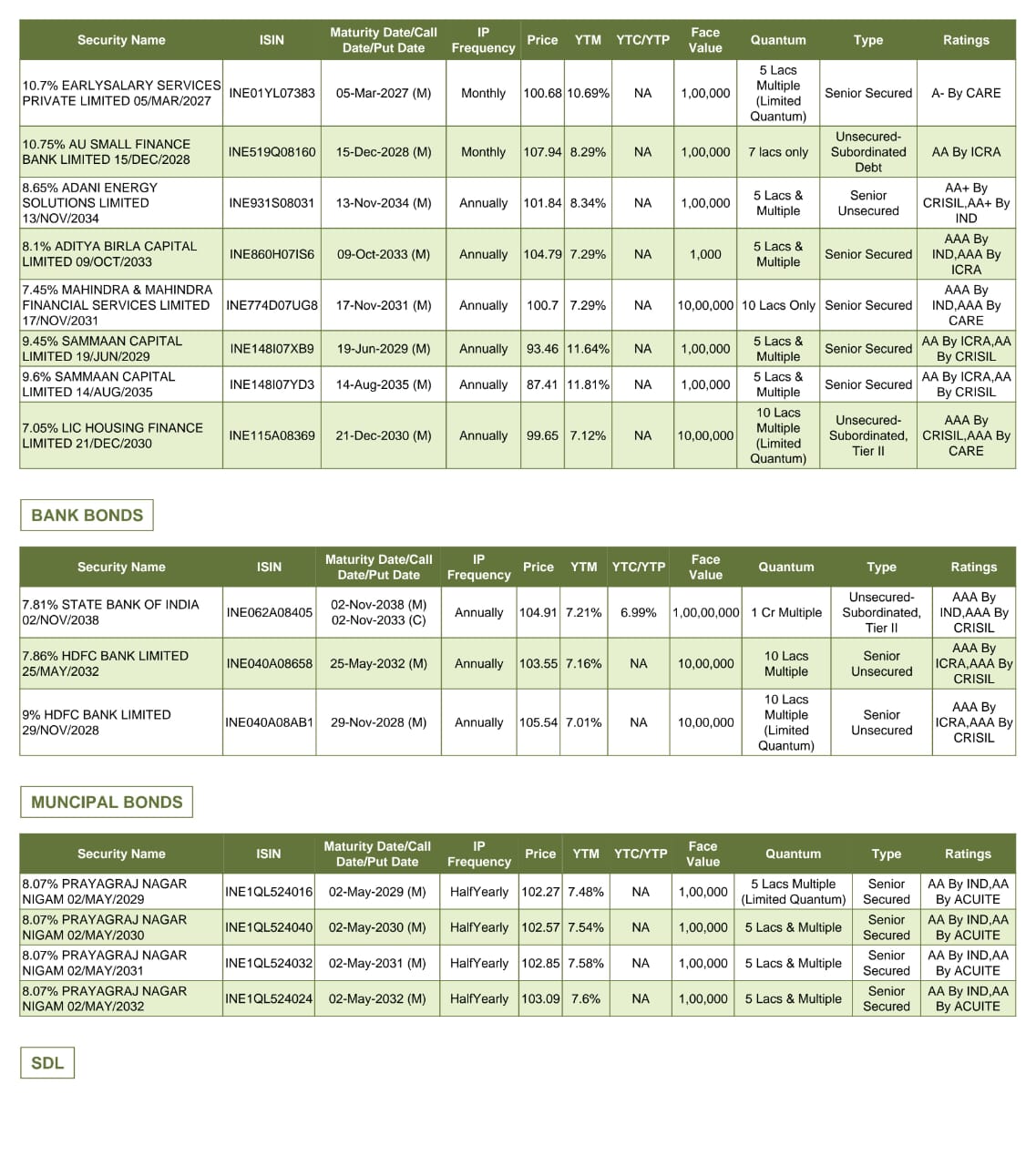

Corporate Bonds

- Issued by companies to raise funds for business growth.

- Offer higher interest rates than government bonds.

- Suitable for investors comfortable with moderate risk for better returns.

Tax-Free Bonds

- Interest earned is exempt from income tax under Section 10(15).

- Long-term investment option with assured income.

- Perfect for individuals in higher tax brackets.

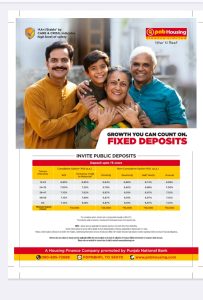

Fixed-Rate Bonds

- Provide a fixed interest rate throughout the tenure.

- Predictable and stable income source.

- Great for retirees or those seeking financial stability.

Floating-Rate Bonds

- Interest rate varies based on market benchmarks.

- Potential for higher returns when interest rates rise.

- Suitable for investors open to some variability in income.